Claiming Expenses Guide

If you're sloppy or maverick about your expenses, you can end-up having to pay for business items from your own personal income. Expenses aren't difficult - just follow our three step guide;

If you're sloppy or maverick about your expenses, you can end-up having to pay for business items from your own personal income. Expenses aren't difficult - just follow our three step guide;

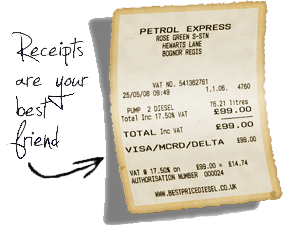

1) Keep all receipts

2) Read our guide

3) ...Seriously, keep all receipts

Every business should encourage employees and directors to pay for expenses on a personal credit card, and claim them back once a month; even if you're a one-person company and you're the only director. We've known disciplined, well-organised directors get into an awful mess because they mixed personal and business money.

When does 24 month rule apply?

The 24 month rule puts some limits on when you can claim travel and subsistence expenses. The 24 month rule applies to any claims for travel and subsistence. This would include fares, mileage, subsistence and hotel & accommodation.

The 24 month rule puts some limits on when you can claim travel and subsistence expenses. The 24 month rule applies to any claims for travel and subsistence. This would include fares, mileage, subsistence and hotel & accommodation.

Employees can claim a fixed amount for every mile of business travel using their own motorcycle or car. The amount per mile allowance covers:

- The cost of fuel

- A contribution towards tyre wear, service costs, car HP payments, insurance, etc.

If you're travelling on business then you can claim the cost of fares by;

If you're travelling on business then you can claim the cost of fares by;

- Train, tube, bus, tram

- Taxi

- Plane

You can claim parking costs while travelling; speeding and parking fines are not allowable.

You must: Remember the 24 month rule applies to any claims. Keep receipts for everything.

The costs of a hotel room or B&B accommodation is allowable for overnight stays while on business. There are no defined limits on the amount but it must be "reasonable". The circumstances and distance must make it "unreasonable" for you to be expected to travel home.

You can claim the full cost of computer hardware, software or consumables used by the Business.

Desktop computer and monitor.

Desktop computer and monitor.- Laptop computer

- Networking equipment: Router, hub, cables

- Smartphones & PDAs

- Peripherals: Laser printer, scanner, projector, graphics tablet

- Software: Windows, Office, development tools

- Accessories: USB drives, Bluetooth adapters, mouse and keyboard

- Upgrades: Memory, internal hard drive, operating system, etc.

Entertaining expenses of taking customers out for meals can be claimed as a business expense; though there is little or no tax benefit in doing so.

Usually entertaining is paid for commercial reasons of securing new contracts rather than to save tax on a night out. For freelancers it often makes sense to pay entertaining and gifts personally to avoid adding back corporation tax calculations and disclosing on P11d forms.

Provided you use the Internet at home for business (checking email, research, etc) then you can claim a proportion of the costs of your Internet service.

Provided you use the Internet at home for business (checking email, research, etc) then you can claim a proportion of the costs of your Internet service.

If the cost is invoiced to, and paid by the business, then incidental personal use will not be treated as a taxable benefit. If the cost is invoiced personally at a flat all-inclusive amount then there is no specific business cost so any amount claimed is likely to be treated as a taxable benefit.If you access the Internet for business while you're mobile or staying away, and pay to use a hotspot or hotel service, claim this as an expense.

Insurances are notoriously confusing as there as so many different types of policies available to businesses. The three most common policies are:

Employers Liability Insurance (EL)

All employers are legally required to have EL, unless the only employee is also the owner. It is there to protect employers against claims from their employees for accidents or sickness caused through work.

All your business postal costs like sending an invoice to a client or sending accounting information to Virtue, are allowable business expenses.

All your business postal costs like sending an invoice to a client or sending accounting information to Virtue, are allowable business expenses.

You must: Have a receipt for everything you claim.

You can claim the cost of using your mobile phone for business.

If the phone bill is invoiced personally then only the business proportion is allowable. You will need to do some work each month to separate out the cost of business and private calls. The rental part of the contract is not allowable and cannot be reclaimed; inclusive minutes are considered part of the rental.

You can claim the cost of printing, mailing, business cards, letterheads, comp-slips, pens, folders, etc.

You can claim the cost of printing, mailing, business cards, letterheads, comp-slips, pens, folders, etc.

You must: Be able to relate what you buy to your business; have a receipt for everything you claim.

Relevant memberships and magazine subscriptions for Groups that appear on the HMRC Approved Subscriptions List are allowable.

A subsistence allowance compensates you for the food, drink and incidental costs associated with staying away on business in a hotel. The allowance isn't intended to cover a fun night out for you and your mates, paid for by HMRC, or free lunch each day.

A subsistence allowance compensates you for the food, drink and incidental costs associated with staying away on business in a hotel. The allowance isn't intended to cover a fun night out for you and your mates, paid for by HMRC, or free lunch each day.

You can claim a reasonable amount for the cost of meals, and an appropriate amount of alcoholic and non-alcoholic drinks with the meal when staying away. The costs of tea, coffee and soft drinks between meals can also be claimed.

Reference guides or training media are allowable as long as they're relevant to the business; whether electronic, web-based or made of recycled trees.

In theory you can claim the business proportion of rent, rates, cleaning, etc. We'd advise you not to do this though as it could lead to capital gains liabilities when you sell your home.

In theory you can claim the business proportion of rent, rates, cleaning, etc. We'd advise you not to do this though as it could lead to capital gains liabilities when you sell your home.

If you can show that you do work at home, the Revenue will allow you to claim £4.00 per week without receipts to justify the claim.

You must: Have a home and do work there occasionally.